Application of Credit Card Payments to Your Balance

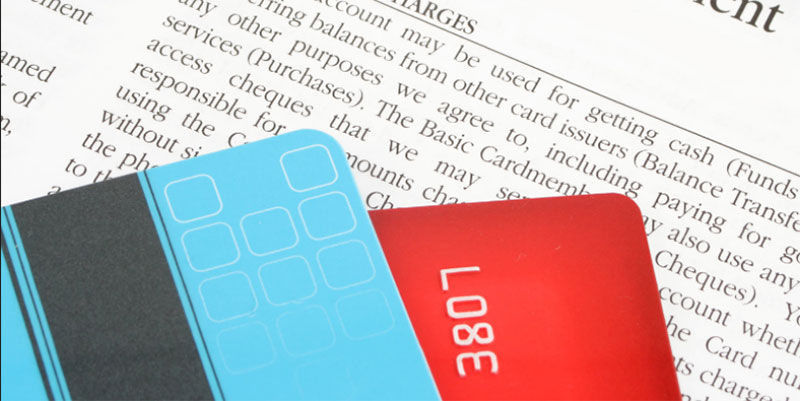

Credit card debt may appear as a single figure on your statement, but the specifics of making credit card payments might need to be clarified. Your total credit card debt may be broken down into several sums depending on how you've used the card.

An amount equal to the value of the goods and services purchased using the card.

One type of amount is a balance transfer balance, which includes payments made initially from another source but now owed on the credit card.

The total money can be withdrawn from an ATM using the card as a cash advance.

Bank Account That Can Hold More Than One Amount

The rates of interest applied to these balances may vary. Your issuer won't contact you to determine how you'd like payments split up among numerous amounts on your account. Instead, it will apply the money to the appropriate accounts consistent with federal regulations.

What is the procedure for purchasing with a credit card?

Your credit card company will split your payment into two pieces because of the Credit Card Act.

You must pay at least the minimum amount specified in your loan agreement each month. The issuer can apply the minimum payment to any outstanding debt. In most cases, the minimum charge will be applied to the account with the lowest interest rate rather than the performance with the highest.

The overage represents all payments made in addition to the required minimum. Card Act compels issuers to prioritize the lowest-interest portion of your amount when processing your payment. After that point, the law typically mandates that the remainder be applied to the other amounts in descending order, according to the yearly percentage rate relevant to the situation.

What are the specifics of credit card repayment?

The following are the current balances on your card. Transferring $640 in proportions at no interest rate is a great deal. Obtain a cash advance for $60 at a 25% APR. A credit of $300 with a 15% interest rate. Instead of the $25 minimum payment, you made a $100 payment. The issuer may divide your money as follows: Because balance transfers have the lowest interest rate, the minimum payment requirement of $25 can be applied to those transactions. Cash advance, which has the highest interest rate, might consume $60. A possible $15 might be allocated to purchases, the category with the second-highest annual percentage rate (APR).

Except for interest-deferral offers,

The most cost-effective choice is often to have the issuer apply the excess payment to the balance with the highest interest rate. Deferred-interest offers, such as those frequently found on retail and medical cards, are generally prohibited by the Card Act, but there is an exception for these offers. It may get rather pricey if you pay off your bills that don't accrue interest until you have to.

However, with a deferred-interest offer, you will be charged interest from the day of purchase forward if you have yet to pay off the entire purchase before the conclusion of the interest-free term.

We are not charging interest on past-due balances.

Assume you decide to finance the purchase of a $1,000 washing machine at a store that offers 0% APR for 12 months if the balance is paid in full and 24% APR for any balances not paid in full by the end of that period. Only $500 will have been repaid after 12 months. The 24% APR applies to the total $1,000 you borrowed, not just the remaining $500.

Let's pretend you've been paying only minimum payments on several of your card balances since you kept using it at the store even after you realized there was no deferred interest on your transactions. If that's the case, avoiding paying interest on past-due balances will be challenging. The Card Act mandates that your issuer prioritize paying down your highest interest balances before making any payments toward your deferred interest.

Prevent allocation issues with your credit card payments.

Controlling your credit card debt can be done in several different ways:

Pick one card to use exclusively for debt. If you're eligible for a 0% interest balance transfer credit card, utilize it to consolidate your existing credit card debt. When making purchases, switch to a credit card that you can pay off monthly. Consolidating debt into a single personal loan may be an alternative to applying for a balance transfer credit card.