Learn and Understand: What is a Routing Number for a Bank Account?

Introduction

Routing numbers are assigned by the American Bankers Association, which assigns each member bank its unique code known as a routing transit number (RTN). This system ensures that money deposited into or withdrawn from an account is quickly pinpointed to ensure efficient processing of the transactions.

Step By Step Guide: How Routing Numbers Work?

Routing numbers are one of the most important pieces of information that you need to provide when transferring money. A routing number is a nine-digit code used in the United States to identify a financial institution, such as a bank or credit union. This number directs payments and funds transfers between banks, allowing them to be accepted and processed quickly. Every time you make an electronic payment — whether a wire transfer, direct deposit, or automatic bill pay — the routing number ensures that your money goes where it needs to go. So how do routing numbers work? Here's a step-by-step guide:

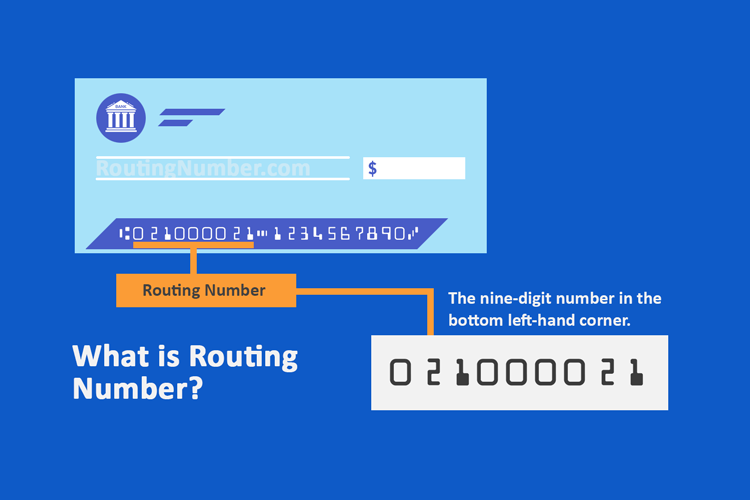

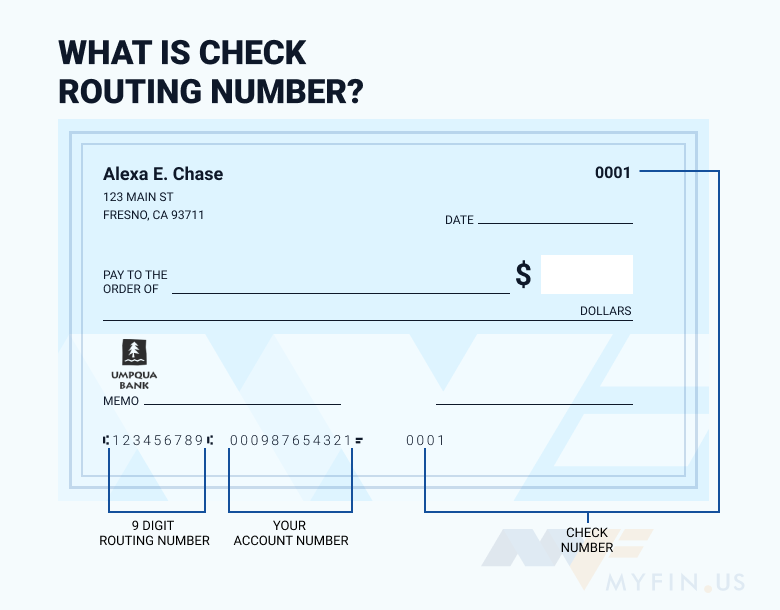

1. Find Your Routing Number

Every financial institution has its unique routing number. The best way to find your routing number is to look at that institution's bottom of a check. It's usually listed in the first set of numbers on the bottom, and it should be nine digits long. If you don'tdon't have access to a check, you can also find it on your bank or credit union's website — search for "routing number" or "check routing number."

2. Provide the Routing Number

Once you know your routing number, you must provide it when sending money electronically. This might include setting up direct deposit with an employer, transferring money between banks or investment accounts, or making an international payment. You will also need to provide the recipient'srecipient's routing number to make sure that the money goes where it needs to go.

3. Check That It's Correct

Whenever you provide a routing number for an electronic payment, it is important to double-check that you have entered it correctly. If the routing number needs to be corrected or updated, your payment may be rejected or take much longer than expected to reach its destination.

4. Understand Routing Number Types

There are three main types of routing numbers used in the United States — ABA (American Bankers Association) numbers, EFT (electronic funds transfer) codes, and MICR (magnetic ink character recognition). Each has different uses, so make sure you know which one you need when providing your routing number. Identifying, providing, and verifying routing numbers is an important part of managing finances successfully.

With this step-by-step guide, you can now confidently and securely send money electronically without worry. Remember: always double-check your routing number — it's the most important piece of information that needs to be right for payments to be processed correctly!

What is the Purpose of Routing Numbers?

Routing numbers are used to identify a customer's bank, allowing for payments and transfers to be processed with accuracy. The routing number is necessary when setting up direct deposit services or making electronic payments such as ACH (automated clearing house) transfers. It can also be used for checks and wire transfers. Additionally, routing numbers are important in identifying where a financial transaction originated. This allows banks to quickly trace the source of funds in fraud or identity theft cases.

Benefits of Routing Numbers

Routing numbers provide several benefits that make banking easier and more efficient:

• They enable accurate processing of payments and transfers.

• They provide a way to trace the source of funds in fraud or identity theft cases.

• The numbers allow faster and more convenient banking services, such as a direct deposit.

• They provide an easy way to set up online bill pay systems.

• The routing numbers can be used to verify an account holder's identity when opening a new bank account.

Important Considerations When Using Routing Numbers

When providing your bank routing number to someone else, it is important to double-check the accuracy of the information provided. The correct number could result in payments and transfers being sent to the correct accounts or not arriving at all, leading to potential financial losses. Additionally, many banks will only accept payments from people within their institution if they have the correct routing number.

How to Find Your Bank's Routing Number

The best way to find your bank's routing number is by looking at the bottom of a check or your monthly statement. Alternatively, most banks provide this information on their website or through customer service. It is also possible to enter your bank name into an online search engine, and you will likely be able to find the information needed that way as well.

Conclusion

Routing numbers are crucial for making sure money transfers happen quickly and accurately between financial institutions. They are necessary when setting up direct deposit services, making electronic payments, sending checks, and conducting wire transfers, among other tasks. Knowing where to find your bank's routing number and understanding how it works will make banking easier, faster, and safer.